Software To File Form 1065

- Business Tax Deadlines

- Business Tax FAQs

- SMB Trump Tax Changes

- SMB Tax Professionals

- SMB Tax Preparer Mistakes

- Business Tax Sofware

Prepare your business taxes using TaxAct, H&R Block, or TurboTax

Form 8453-PE must be signed and dated before the form is attached to the electronic file. Forms 8878-A and 8879-PE are held by the preparer unless requested by the IRS. For information about attaching Form 8865 electronic file to the partnership return electronic file in UltraTax/1065, see Filing and attaching Form 8865 to electronic files.

As a business owner, you might be considering online or desktop software if you prefer doing your own taxes. Three major tax software programs—TurboTax, H&R Block, and TaxAct—offer both online and desktop versions to prepare federal income tax returns as well as your state business tax returns.

You can use a specific version of one of these programs to prepare W-2 forms for employees and 1099 forms for non-employees if you hire them. (A listing of these forms in the features only means that they can be used for your tax return, not to prepare for others.)

What Forms Do You Need?

The software you need depends on your business type and the federal income tax forms you must file. You would file Schedule C, along with your personal tax return if you're a sole proprietor or single-member LLC, so you'll need a tax software version that includes Schedule C.

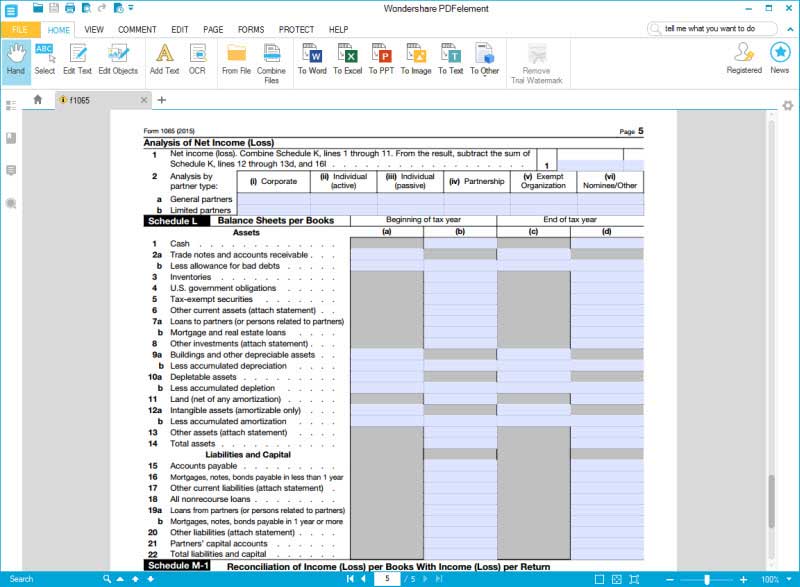

You'll need tax software that includes Form 1120 if you're a corporation, or software that includes Form 1120S if you're an S corp. You'll need software with Form 1065 if you're a partnership or multiple member LLC.

What These Tax Programs Include—And Don't Include

All three major tax preparation programs offer options for businesses, but the way they offer them differs. The business option might be an all-business one (in TurboTax, for example) or you might need to select a specific business type (in TaxAct).

If you are filing your business taxes on Schedule C, the option you get will also include forms to prepare your personal taxes for the year. The Schedule C programs also help you calculate your self-employment tax (Schedule SE) and include it in the appropriate sections of your personal tax return.

You'll have to buy a separate program for your personal taxes if you purchase software for partnerships, corporations, or multiple member LLCs. These preparation programs don't always include personal tax-return information, although the products can sometimes be bundled.

If you have employees and/or non-employees who do work for you, you might want to find software that prepares W-2 forms and 1099-MISC forms.

All of these companies offer online support, but be careful about who you trust. Complicated business tax questions should only be answered by CPAs or Enrolled Agents.

Here are three top business income tax software options (in alphabetical order):

Note: H&R Block for Business Income Tax Returns

H&R Block offers online tax preparation for small businesses with their Self-Employed Online version, including Schedule C and Schedule SE. The cost is $79.99, with an extra cost of $36.99 for a state return. They also have a Premium online version that is only for small businesses with less than $5000 in expenses to file Schedule C-EZ, at $49.99 plus $36.95 for one state.

The Premium version, available in a download version for Windows and Mac OS is $74.95 and one state is included, but you have to pay $19.95 for state e-file. This version says 'self-employed tax software,' and it does include both Schedule C and Schedule SE.

The Premium & Business download version (only available for Windows OS) includes Schedule C, corporation, S corporation, partnership, LLC, and non-profit organization tax forms for $89.95, and you can prepare up to five federal returns. State software is included but state e-file is $19.95 each.

The Premium & Business version includes the ability for you to create payroll tax returns as well, including W-2s and 1099-MISC forms, a feature not offered by TurboTax or TaxAct (as far as I can tell). This is the only H&R Block program that will allow you to create and file W-2 forms and 1099 forms.

H&R Block offers more than 12,000 retail offices around the country. You can meet with someone in person to help you straighten things out if you run into a problem. A professional will review your return for accuracy if you request a Tax Pro Review online.

Unlimited business state returns are included, but state e-file is an additional fee. You can prepare your personal return on both the Premium & Business and Self-Employed editions.

File 1065 Free

TaxAct for Business Income Tax Returns

TaxAct is one of the least expensive options available. For 2018 taxes for self-employed and freelancers, you'll need the Self-employed+ edition (online). This version is $49.95 for one filing (personal return plus Schedule C and Schedule SE). State filing is additional at $6.95 each. You don't pay until you file.

The download edition is called the Self-Employed Edition. It's available for $96.90 with five free federal e-files and one free state return. (It looks like no CD version is available).

The online versions of TaxAct products are available for Windows and Mac, but the download version is only available for Windows. TaxAct doesn't have a version of its software that includes the ability to create W-2 forms and 1099 forms.

Business tax-return products from TaxAct for 2018 are all $59.95 each: Form 1040 and Schedule C Form 1065 for partnerships, Form 1120-S for S Corporations, and Form 1120 for C Corporations. The cost includes only one return, with an additional cost for a state return. Download versions or online versions are both available, but the download versions are not available for Mac OS.

TaxAct offers bundles: one personal return, and one of the business returns for $200 each. These include one business return plus TaxAct Self-employed federal and state. It may be worth checking out their tax tools, including the self-employment tax calculator.

Turbotax for Business Income Tax Returns

For Schedule C filers, TurboTax offers several options, based on your business type and whether you want online or download/CD.

The 2018 Turbotax Home and Business edition is available in CD/download options to file a personal tax return including Schedule C and Schedule SE. The download version is available for both Mac and Windows. It costs $109.99 as of 2018, and this includes one state return and free federal e-file. Valkyrie profile torrent psp 2015.

The Turbotax Self-Employed edition is the online version, at a cost of $89.99 for one federal return (state additional), including a personal tax return, Schedule C and Schedule SE. This version accommodates income generated from goods and services, as well as 1099-MISC forms.

You can prepare and file both Schedule C and your personal return. This year the self-employed edition comes with QuickBooks Self-employed, QuickBooks Self-employed is an online version, for very small businesses, to track income and expenses for tax purposes. It includes ways to organize receipts with the use of a phone.

Corporations, S corporations, and partnerships, including multiple-member LLCs, will need TurboTax Business, either the online or CD/download version. Forms for all business types are included. The cost is $159.99 for a federal return, with 5 federal e-files included. State filing is additional at $59.99 per state.

Turbotax Business allows you to create W-2, 1099-MISC, 1099-INTd, 1099-DIV and K-1 forms. You can import your business information from QuickBooks desktop versions. TurboTax offers audit support for an additional cost.

Should You Do Your Own Business Taxes?

Software To File Form 1065 Return

Even if you're able to purchase software to do your business taxes, the question still remains whether you should try to complete this task on your own.

You might think that it's not much of a challenge to do your own business taxes along with your personal taxes if you're filing a very simple tax return with Schedule C. Just don't forget that you must still calculate and pay self-employment taxes if your small business has a profit for the year. TurboTax will remind you.

Software To File Form 1065 Online

You might want to enlist the help of a tax professional who's familiar with the appropriate type of return if you're faced with preparing a more complex business tax return for a partnership, multiple member LLC, or corporation.